When Hurricane Sandy hit the East Coast in 2012, it didn't just knock out power lines: it exposed the devastating reality of how unprepared most small businesses were for disaster. Within 72 hours, 25% of affected Connecticut small businesses had permanently closed their doors. Not because of physical damage, but because they had no plan to continue operating when their normal systems failed.

Fast forward to 2025, and the statistics haven't improved. According to recent FEMA data, 40% of small businesses never reopen after a major disaster, and 90% of companies that can't resume operations within five days will fail within a year. Yet despite these sobering numbers, most Connecticut SMBs are still making the same critical business continuity mistakes that guarantee failure when crisis strikes.

The harsh truth? Business continuity isn't just about natural disasters anymore. Cyberattacks, supply chain disruptions, key employee departures, and even extended power outages can cripple unprepared businesses within hours. The companies that survive and thrive are those that recognize business continuity as an operational necessity, not an optional insurance policy.

Mistake #1: Treating Backup as Business Continuity

The most dangerous misconception plaguing Connecticut small businesses is believing that data backup equals business continuity planning. While data backup is crucial, it represents just one piece of a comprehensive continuity strategy. When ransomware hit a Hartford accounting firm last year, they discovered their cloud backup was worthless: they had no plan for operating without their primary systems, no alternative communication methods, and no process for serving clients while systems were down.

True business continuity encompasses your entire operational framework. It includes alternative work locations, backup communication systems, supplier redundancies, staff cross-training, and detailed recovery procedures. Your backup might preserve your data, but can your business actually function while you're restoring it?

Consider the essential systems your business relies on daily: customer relationship management, inventory management, payment processing, communication tools, and financial systems. For each system, you need both a backup plan and an operational workaround. The coffee shop that can only process credit cards is just as vulnerable as the consultancy that loses access to client files.

A comprehensive continuity plan identifies every potential single point of failure in your operations and creates redundancy for critical functions. This includes maintaining relationships with multiple suppliers, training employees to handle various roles, and establishing alternative methods for your most important business processes.

The financial impact of this mistake is severe. Businesses that can only operate with their primary systems typically face 5-10 days of complete downtime during recovery, resulting in lost revenue, frustrated customers, and often permanent client defection. Companies with proper continuity plans typically resume core operations within 4-12 hours, minimizing both financial loss and reputational damage.

Mistake #2: Focusing Only on Technology Disasters

Connecticut businesses often develop continuity plans that address only technology failures: cyber attacks, server crashes, or software outages. While these scenarios are important, they represent just one category of potential disruptions. Real-world business continuity challenges are far more diverse and often more disruptive.

Key employee departures can instantly cripple small businesses, especially when those employees hold exclusive knowledge about critical processes or client relationships. The sudden departure of your lead developer, primary salesperson, or operations manager can be more devastating than any server failure. Yet most continuity plans don't address human resource disruptions.

Supply chain interruptions pose another major risk. When your primary vendor experiences problems, can your business continue operating? The pandemic demonstrated how quickly supplier relationships can evaporate, leaving businesses scrambling for alternatives. Companies that maintained relationships with multiple suppliers weathered these disruptions far better than those dependent on single sources.

Physical access problems create unexpected challenges. Building closures, transportation disruptions, or even parking restrictions can prevent employees from reaching the office. The most sophisticated IT infrastructure becomes useless if your team can't access it. Remote work capabilities aren't just pandemic precautions: they're essential continuity measures.

Financial disruptions deserve special attention. Bank failures, payment processor outages, or cash flow interruptions can halt operations even when all systems function perfectly. Maintaining relationships with multiple financial institutions and keeping emergency cash reserves provides crucial operational flexibility during crises.

Environmental factors beyond natural disasters can disrupt business. Extended power outages, water system failures, or even construction projects can make facilities unusable. Having alternative work locations or flexible operating procedures ensures business continuity regardless of the specific disruption.

The most resilient businesses develop continuity plans that address operational disruptions from any source. This comprehensive approach recognizes that business continuity is about maintaining essential functions regardless of what causes the interruption.

Mistake #3: Creating Plans Without Testing Them

Perhaps the most costly mistake Connecticut SMBs make is developing detailed business continuity plans that exist only on paper. These theoretical plans often fail spectacularly during real emergencies because they haven't been tested, refined, or practiced. It's like having a fire escape route you've never walked: when seconds count, unfamiliarity can be deadly.

Testing reveals critical flaws in continuity planning. During a simulated cyber attack exercise, a New Haven marketing agency discovered their backup servers were corrupted, their emergency contact list was outdated, and their alternative communication system couldn't handle the team's workflow. Without testing, they would have learned these facts during an actual emergency, when fixing them would be impossible.

Regular testing also builds muscle memory among your team. Employees who have practiced continuity procedures can execute them efficiently during high-stress situations. Those encountering procedures for the first time during an emergency often make critical errors or waste precious time figuring out unfamiliar processes.

Testing schedules should vary to address different scenarios. Quarterly tests might simulate cyber attacks or system failures, while annual exercises could address facility evacuations or key employee departures. Each test should include specific metrics for success: how quickly can you restore essential functions? How effectively can your team communicate? How well do backup systems perform under load?

Documentation is crucial during testing. Every test should produce a written report identifying what worked, what failed, and what needs improvement. This continuous refinement process transforms theoretical plans into practical, proven procedures. Many businesses discover that their initial continuity plans require significant modifications after real-world testing.

Post-test improvements often reveal unexpected dependencies. The dental practice that tested their continuity plan discovered that their appointment scheduling system couldn't sync with their backup patient database, creating confusion about patient appointments. This discovery led to system upgrades that prevented major disruptions during an actual server failure six months later.

Testing also validates your vendor relationships. Backup services that work perfectly during normal operations sometimes fail under emergency conditions. Load balancing, bandwidth limitations, and support availability can all vary during crisis situations. Testing reveals these limitations while you can still address them.

Mistake #4: Ignoring Employee Communication and Training

Business continuity plans fail when employees don't understand their roles during emergencies. Even the most comprehensive plan becomes worthless if your team doesn't know how to execute it. This communication gap is particularly dangerous for small businesses where individual employees often wear multiple hats and play crucial roles in emergency response.

Effective continuity training goes beyond simply distributing written plans. Employees need to understand not just what to do, but why specific procedures matter and how their actions connect to overall business survival. The receptionist who understands that maintaining customer communication during outages prevents permanent client loss will approach emergency procedures more seriously than someone who views them as administrative tasks.

Role-specific training ensures each team member knows their emergency responsibilities. Your IT person needs detailed technical procedures, your office manager needs client communication protocols, and your sales team needs alternative methods for serving customers. Generic training often leaves critical gaps in emergency response.

Communication systems during emergencies require special attention. When primary phone and email systems fail, how will your team coordinate? Alternative communication methods: backup phone numbers, messaging apps, or even text chains: need to be established, tested, and practiced. Many businesses discover during emergencies that their chosen backup communication methods don't work as expected.

Regular refresher training keeps continuity procedures fresh in employees' minds. Annual training sessions often reveal that staff have forgotten key procedures or that employee turnover has created knowledge gaps. New employees especially need thorough continuity training as part of their onboarding process.

Employee feedback improves continuity planning. Your team often identifies practical problems that managers miss. The warehouse worker who points out that backup generators can't power the loading dock equipment provides valuable insight for refining emergency procedures. Regular feedback sessions help identify and address these real-world implementation challenges.

Cross-training creates operational resilience by ensuring multiple employees can handle critical functions. When your primary bookkeeper is unavailable during an emergency, having backup personnel who understand essential financial processes maintains business operations. This redundancy is particularly important for small businesses where individual employees often possess unique, critical knowledge.

Mistake #5: Underestimating Recovery Time and Costs

Connecticut small businesses consistently underestimate both the time and money required for disaster recovery, leading to inadequate preparation and unrealistic expectations. This optimism bias can be fatal when actual emergencies occur and businesses discover their recovery assumptions were dangerously wrong.

Recovery timeframes vary dramatically based on the type and severity of disruption. Cyber attacks often require 1-3 weeks for complete system restoration, including security auditing and data verification. Physical disasters might require months to rebuild facilities and restore full operations. During Hurricane Sandy, many Connecticut businesses that expected to reopen within days remained closed for months due to infrastructure damage and supplier disruptions.

Financial recovery costs extend far beyond obvious expenses like equipment replacement or facility repairs. Lost revenue during downtime, emergency vendor premiums, temporary facility costs, and overtime employee compensation can quickly exceed direct damage costs. The manufacturing company that budgeted $50,000 for post-fire recovery actually spent $200,000 when they factored in lost contracts, temporary workspace rental, and expedited equipment delivery.

Insurance coverage gaps create unexpected financial burdens. Business interruption insurance might not cover all lost revenue, especially for seasonal businesses or those with fluctuating income. Cyber insurance might exclude certain types of attacks or limit coverage for specific recovery expenses. Understanding exact coverage details before emergencies occur prevents unpleasant financial surprises during recovery.

Customer retention costs often exceed initial estimates. Clients who find alternative service providers during your downtime may not return when you resume operations. Winning back these customers typically requires significant marketing expenditures, discounted pricing, or additional service offerings. The lost lifetime value of departed customers often represents the largest financial impact of business disruptions.

Employee productivity recovery takes longer than most businesses expect. Even after systems are restored, employees need time to catch up on backlogged work, relearn modified procedures, and adjust to any operational changes. This productivity ramp-up period can extend the financial impact of disruptions well beyond the initial recovery phase.

Vendor relationship recovery requires careful management. Suppliers who found alternative customers during your downtime might not immediately resume previous service levels. Rebuilding these relationships often requires financial incentives or contractual commitments that increase long-term costs.

Building Resilient Business Continuity Plans

Effective business continuity planning starts with honest risk assessment. Identify every potential disruption that could affect your operations, from cyber attacks and natural disasters to key employee departures and supplier failures. Prioritize these risks based on likelihood and potential impact, focusing your preparation efforts on the most critical threats.

Comprehensive planning addresses all aspects of your operation. Map out your essential business functions: those activities that must continue for your business to survive. For each function, identify the resources, personnel, and systems required. Then develop alternative methods for maintaining these functions when primary resources are unavailable.

Documentation should be detailed but actionable. Your continuity plan needs step-by-step procedures that any employee can follow during high-stress situations. Include contact information for key personnel, vendors, and emergency services. Make sure backup documentation is stored securely but accessibly, both digitally and physically.

Testing and refinement transform theoretical plans into practical procedures. Schedule regular exercises that simulate different types of disruptions. Document what works and what doesn't, then update your plans accordingly. This iterative process ensures your continuity procedures remain effective as your business evolves.

Employee engagement ensures effective plan execution. Train your team on their emergency roles and responsibilities. Practice communication procedures and decision-making protocols. Foster a culture where business continuity is viewed as everyone's responsibility, not just management's concern.

Professional support can enhance your planning efforts. Managed IT service providers can help design and test technology continuity procedures. Insurance professionals can identify coverage gaps and recommend appropriate policies. Legal advisors can review contracts for continuity-related clauses.

The businesses that survive and thrive through disruptions are those that view continuity planning as an ongoing operational priority rather than a one-time exercise. They understand that in an interconnected, technology-dependent economy, resilience isn't optional: it's essential for long-term success.

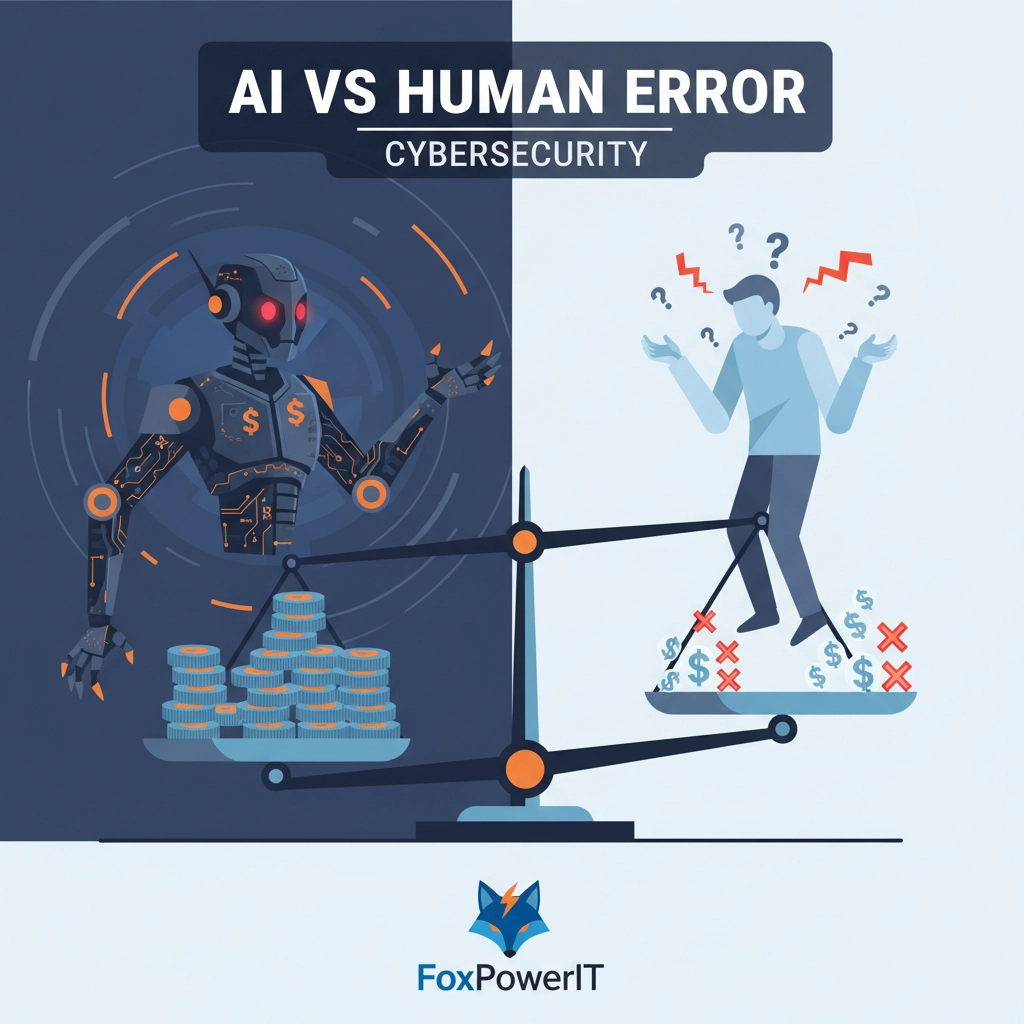

Human Error vs. AI Threats: Which Is Really Costing Connecticut Small Businesses $250K+ in 2025? (The Shocking Truth)

The emergency call came in at 3:47 AM. Sarah, owner of a thriving Hartford consulting firm, watched in horror as her company's client database was being systematically destroyed. The intrusion detection system was screaming alerts, logs showed suspicious AI-powered automated attacks, and her IT consultant was frantically trying to isolate compromised systems.

Three hours later, the shocking truth emerged: there was no sophisticated AI attack. Instead, a well-meaning employee had clicked on what appeared to be a legitimate software update email, inadvertently installing malware that mimicked AI attack patterns. The "AI threat" that seemed to be methodically destroying her data was actually classic human error amplified by automated malicious software.

This scenario plays out hundreds of times each month across Connecticut, as small businesses struggle to distinguish between emerging AI-powered threats and the persistent danger of human mistakes. While headlines focus on artificial intelligence risks, the data reveals a more complex reality: human error remains the dominant cause of costly security incidents, but AI is rapidly changing how these mistakes cascade into catastrophic losses.

The Real Numbers: Human Error Still Dominates

Despite the media focus on AI-powered cyber attacks, human error continues to account for 82% of data breaches affecting Connecticut small businesses in 2025. These aren't just simple mistakes: they're costly errors that average $247,000 in total impact when including lost revenue, recovery costs, regulatory fines, and reputational damage.

The most expensive human errors involve email-based social engineering. Connecticut businesses lose an average of $89,000 per incident when employees wire funds to fraudulent accounts, share credentials with fake IT support requests, or download malicious attachments disguised as legitimate documents. These losses have increased 34% since 2023, not because attacks have become more sophisticated, but because the financial stakes have grown higher.

Misconfiguration errors cost Connecticut SMBs an average of $156,000 per incident. When employees incorrectly configure cloud services, database permissions, or security settings, the resulting data exposure can trigger regulatory penalties, legal costs, and business interruption. A New Haven medical practice paid $180,000 in HIPAA fines after an employee accidentally made patient records publicly accessible through a misconfigured cloud storage setting.

Password-related human errors generate surprising financial impact. Weak passwords, shared credentials, and reused login information contribute to 67% of successful unauthorized access incidents. While individual password compromises might seem minor, they often provide attackers with initial access that leads to much larger breaches. The average Connecticut small business spends $43,000 recovering from password-related security incidents.

Physical security mistakes create unexpected vulnerabilities. Employees leaving laptops in vehicles, failing to lock workstations, or discussing sensitive information in public spaces contribute to 23% of data breaches affecting Connecticut SMBs. These seemingly minor oversights can expose customer information, trade secrets, and financial data to competitors or malicious actors.

Training investments show measurable returns. Businesses that implement comprehensive security awareness programs experience 68% fewer costly human error incidents. However, most Connecticut small businesses still rely on annual security presentations rather than ongoing, practical training that addresses real-world scenarios employees actually encounter.

The Emerging AI Threat Landscape

While human error dominates current statistics, AI-powered attacks are becoming more sophisticated and harder to detect. These attacks often succeed not through technical complexity but by exploiting human psychology more effectively than traditional approaches.

AI-generated phishing emails now bypass most traditional detection methods. Machine learning algorithms analyze successful phishing campaigns to create personalized messages that match individual communication patterns, reference recent news events, and include contextually relevant details that make fraudulent emails nearly indistinguishable from legitimate correspondence.

Voice cloning technology enables "vishing" attacks that fool even security-conscious employees. Attackers use AI to replicate executives' voices, calling employees with urgent requests for wire transfers, credential sharing, or confidential information. A Stamford law firm lost $67,000 when an employee received what appeared to be a voicemail from the managing partner requesting an emergency client payment.

Automated vulnerability scanning accelerates attack timelines. AI-powered tools can identify and exploit security weaknesses within hours of systems going online. This compressed attack window leaves little time for traditional human-based monitoring to detect and respond to threats. The average time between vulnerability exposure and exploitation has dropped from weeks to hours for AI-assisted attacks.

Deepfake technology creates new social engineering possibilities. Attackers use AI-generated video calls to impersonate trusted contacts, making fraudulent requests that employees find difficult to verify. While still relatively rare, these attacks are becoming more accessible as deepfake technology improves and costs decrease.

AI-powered credential stuffing attacks test millions of username and password combinations against business systems within minutes. These automated attacks succeed when employees reuse passwords across multiple platforms or choose easily guessable credentials. The speed and scale of AI-assisted password attacks make manual detection nearly impossible.

Behavioral analysis helps attackers customize their approaches. AI systems analyze targets' social media activity, professional relationships, and communication patterns to craft highly personalized attack strategies. This intelligence gathering enables attackers to create convincing pretexts that exploit specific psychological triggers.

The Amplification Effect: When AI Meets Human Error

The most dangerous security scenarios occur when AI-powered attacks exploit human psychological weaknesses. This combination creates cascading failures that can destroy small businesses within hours rather than days or weeks.

AI-generated urgency creates decision-making pressure that overrides security training. Automated systems can generate seemingly urgent scenarios: system failures, compliance deadlines, or customer emergencies: that pressure employees to bypass normal verification procedures. These artificially created time constraints exploit human tendencies to act quickly under pressure.

Personalized social engineering becomes nearly undetectable when AI systems analyze targets' digital footprints to create highly credible attack scenarios. Attackers use AI to research targets' professional relationships, recent activities, and communication patterns, then craft messages that reference specific details only trusted contacts would know.

Volume amplification multiplies the impact of individual mistakes. Where traditional attacks might target one or two employees, AI-powered campaigns can simultaneously attack hundreds of employees with personalized messages. This increases the probability that someone will make a mistake while making detection more difficult due to the distributed nature of the attack.

Adaptive learning allows AI attacks to evolve in real-time based on employee responses. If initial phishing attempts fail, AI systems automatically adjust their approach, trying different psychological triggers or communication styles until they find effective methods. This persistence often succeeds where static attacks would fail.

The integration of multiple attack vectors creates complex scenarios that overwhelm traditional defenses. AI-orchestrated campaigns might combine email phishing, voice calls, text messages, and social media contacts to create seemingly coordinated communications from trusted sources. Employees receiving consistent messages across multiple channels often assume they're legitimate.

Financial Impact Analysis: Connecticut SMB Reality Check

The true cost of security incidents extends far beyond immediate technical remediation. Connecticut small businesses face multifaceted financial impacts that can threaten long-term viability, especially when incidents involve both human error and AI-enabled attacks.

Direct incident response costs average $47,000 for Connecticut SMBs experiencing significant security breaches. This includes forensic analysis, system restoration, security consulting, and legal fees. However, these immediate costs typically represent only 15-20% of total financial impact.

Business interruption losses often exceed direct response costs. When security incidents disrupt operations, Connecticut small businesses lose an average of $8,200 per day in lost revenue. For businesses with critical online operations or just-in-time inventory systems, daily losses can exceed $25,000. Complete recovery to normal operations typically requires 12-18 days for human error incidents and 21-35 days for AI-enhanced attacks.

Regulatory penalties vary by industry but can be substantial. HIPAA violations cost healthcare providers an average of $142,000 per incident, while financial services companies face average fines of $89,000 for data protection violations. Connecticut's data protection regulations add additional penalty layers for businesses handling state resident information.

Customer acquisition costs increase significantly after security incidents. Businesses typically spend 3-5 times their normal marketing budget to regain customer confidence and replace departed clients. Professional service companies often see 40-60% client turnover following major security breaches, requiring substantial investment to rebuild their customer base.

Cyber insurance premiums increase dramatically after claims. Connecticut SMBs typically see insurance costs double or triple following major security incidents, adding ongoing financial burden to recovery costs. Some businesses become uninsurable, forcing them to self-fund future security risks.

Legal costs compound when breaches involve customer data or business partner information. Litigation expenses for Connecticut SMBs average $67,000 per security incident, including both defensive legal costs and potential settlement payments. Class action lawsuits, while less common for small businesses, can create existential financial threats.

Practical Defense Strategies That Actually Work

Effective security requires addressing both human factors and technological threats with integrated approaches that recognize the interaction between AI-powered attacks and human psychology.

Multi-factor authentication provides the strongest return on investment for Connecticut small businesses. Even when employees make mistakes with passwords or fall for phishing attacks, MFA prevents 89% of unauthorized access attempts. Implementation costs are typically under $50 per employee annually, while preventing incidents that cost thousands of dollars.

Security awareness training must evolve beyond annual presentations to include regular, practical exercises. Simulated phishing campaigns help employees recognize real attacks while providing measurable training effectiveness metrics. The most successful programs combine monthly micro-training sessions with quarterly simulated attack exercises.

Zero-trust architecture limits damage when human errors occur. By requiring verification for every access request, zero-trust systems contain breaches even when attackers obtain legitimate credentials. While implementation requires significant upfront investment, zero-trust approaches reduce average breach costs by 73% for Connecticut SMBs.

Automated monitoring systems detect AI-powered attacks that human administrators miss. Machine learning-based security tools can identify unusual patterns, anomalous communications, and suspicious user behaviors that indicate ongoing attacks. These systems are particularly effective against AI-generated threats that mimic legitimate activities.

Incident response planning reduces recovery time and costs when security failures occur. Businesses with documented, tested response procedures resume normal operations 60% faster than those without formal incident response capabilities. Regular tabletop exercises help identify response plan weaknesses before real incidents occur.

Vendor security assessments ensure third-party relationships don't create vulnerabilities. Connecticut SMBs increasingly face attacks that originate through trusted vendors or service providers. Regular security assessments and contractual security requirements help maintain security standards across business relationships.

The Strategic Balance: Human + AI Defense

The most effective security strategies recognize that human judgment and AI-powered tools complement each other rather than compete. Connecticut businesses achieve optimal security postures by combining human intuition with automated threat detection and response capabilities.

Human analysts excel at understanding context, recognizing unusual patterns, and making judgment calls that consider business impact alongside security requirements. These capabilities remain crucial for evaluating complex threats, making risk-based decisions, and adapting security measures to changing business needs.

AI systems provide speed, consistency, and pattern recognition that human analysts cannot match. Automated tools can monitor millions of events simultaneously, detect subtle indicators of compromise, and respond to threats within seconds rather than hours. This capability is essential for defending against high-volume, fast-moving AI-powered attacks.

The optimal approach combines automated threat detection with human oversight and decision-making. AI systems can flag potential threats, gather relevant information, and suggest response options, while human analysts evaluate recommendations, consider business context, and authorize appropriate responses.

Training programs should prepare employees to work effectively with AI security tools rather than be replaced by them. This includes understanding how to interpret automated alerts, when to escalate decisions to human analysts, and how to provide feedback that improves system performance over time.

Regular strategy reviews ensure security approaches remain effective as threats evolve. The threat landscape changes rapidly, with new AI capabilities and human psychological exploits emerging continuously. Connecticut SMBs need quarterly security strategy reviews to assess effectiveness and adapt to new challenges.

Professional partnerships with managed security service providers can provide access to advanced AI security tools and expert human analysis that most small businesses cannot maintain internally. These partnerships offer scalable security capabilities that adapt to changing threat levels and business requirements.

The bottom line for Connecticut small businesses: while AI-powered attacks represent emerging threats requiring new defensive strategies, human error remains the dominant cause of costly security incidents. The most effective approach addresses both challenges through integrated strategies that recognize the complex interaction between human psychology and artificial intelligence in modern cybersecurity landscapes.

Virtual CIO Services Secrets Revealed: What Connecticut IT Companies Don't Want SMBs to Know About Cutting IT Costs by 45%

The CFO at a thriving Stamford manufacturing company nearly choked on his coffee when he saw the IT budget proposal for 2025: $340,000 for a full-time Chief Information Officer, plus benefits, recruitment costs, and the risk of hiring someone whose expertise might not match their evolving needs. Three months later, after implementing virtual CIO services at $45,000 annually, he was getting the same strategic IT leadership while saving over $250,000: a cost reduction of 87%.

This isn't an isolated success story. Across Connecticut, small and medium businesses are discovering that virtual CIO (vCIO) services don't just cut costs: they often provide superior strategic value compared to full-time IT executives. The cost savings from virtual CIO services actually exceed the 45% figure suggested by most industry reports. When Connecticut small businesses compare a full-time IT Director costing $180,000-$220,000 annually in total investment against virtual CIO services running $20,000-$45,000 per year, they're looking at savings ranging from 78% to 89%.

Yet many IT companies downplay these advantages because virtual CIO services threaten their traditional staffing model. The secret they don't want you to know? Virtual CIO services often deliver better strategic outcomes than full-time hires, while costing a fraction of traditional IT leadership approaches.

The Hidden Cost Breakdown Most Businesses Miss

When evaluating IT leadership options, most Connecticut businesses focus solely on salary comparisons: and that's exactly what traditional IT companies want. The real financial picture is far more complex and heavily favors virtual CIO services.

A full-time IT Director in Connecticut commands an average salary between $130,000-$160,000 annually, but that's only the beginning. The total annual investment balloons to $180,000-$220,000 once you factor in benefits, payroll taxes, recruitment costs, training expenses, and the risk of hiring someone whose skills don't match your evolving needs. Nationally, hiring an in-house CIO can run businesses between $245,000 to $428,000 annually in 2025.

Benefits and payroll taxes add 25-30% to base salaries. Health insurance, retirement contributions, workers' compensation, unemployment insurance, and Social Security taxes transform a $150,000 salary into a $195,000 total compensation package. For small businesses, these additional costs often come as surprises during budget planning.

Recruitment expenses frequently exceed $15,000 for senior IT positions. Executive search firms charge 20-25% of first-year salary for CIO placements, while internal recruitment costs include job posting fees, candidate travel expenses, and the hidden cost of management time spent interviewing and evaluating candidates.

Training and certification costs continue throughout employment. Technology evolves rapidly, requiring ongoing education to maintain relevant expertise. Annual training budgets for senior IT executives typically range from $5,000-$12,000, including conference attendance, certification maintenance, and skill development programs.

Risk mitigation costs often go unrecognized until problems occur. When a full-time IT executive doesn't work out, replacement costs can exceed $50,000 in recruitment fees, training time, and operational disruption. The average tenure for IT executives is 3.2 years, meaning many businesses face these replacement costs multiple times.

Virtual CIO services eliminate most of these hidden expenses. Service fees typically include all training, certification, and skill development costs. There are no benefits, payroll taxes, or recruitment expenses. If the service relationship doesn't work out, switching providers costs nothing beyond the transition time.

Strategic Value Beyond Simple Math

The cost differential represents only part of the advantage. Virtual CIOs provide strategic benefits that full-time employees often cannot match, particularly for small and medium businesses with limited IT budgets and diverse technology needs.

Industry expertise across multiple sectors gives virtual CIOs unique perspective on best practices, emerging trends, and cost-effective solutions. While a full-time IT executive might have deep experience in one or two industries, virtual CIOs work with clients across healthcare, manufacturing, professional services, and retail sectors. This diversity enables them to bring proven solutions from other industries to solve your specific challenges.

Vendor neutrality ensures technology recommendations prioritize business objectives over vendor relationships. Full-time IT executives often develop preferences for specific vendors or technologies, sometimes influenced by personal relationships or career considerations. Virtual CIOs maintain independence from vendor partnerships, providing objective evaluations based solely on business requirements.

Up-to-date knowledge of emerging technologies comes naturally when virtual CIOs work with dozens of clients facing similar challenges. They see firsthand how new technologies perform in real business environments, which solutions deliver promised benefits, and which implementations typically encounter problems. This exposure provides insights that no individual executive could gain working for a single company.

Immediate availability eliminates the lengthy hiring process typical for senior IT positions. Virtual CIO services can begin within days of engagement, providing strategic guidance during critical technology decisions. The average time to hire a qualified IT executive exceeds 120 days, during which important strategic decisions often get delayed or made without proper expertise.

Scalable expertise adapts to changing business needs without personnel management complexity. During technology implementations or strategic planning periods, virtual CIO involvement can increase. During stable operational periods, service levels can decrease. This flexibility eliminates the feast-or-famine utilization typical with full-time executives.

Network access provides connections to specialized experts for specific projects. Virtual CIOs maintain relationships with implementation specialists, security experts, and technology vendors that can benefit client projects. These connections often save significant time and money during technology implementations.

The Sweet Spot for Maximum ROI

Virtual CIO services prove most effective for businesses with $2 million to $25 million in annual revenue. Companies in this range typically manage 10-30 employees, operate multiple locations, and juggle various technology systems requiring coordination: enough complexity to benefit from strategic guidance without the budget for full-time executive IT leadership.

Technology dependency levels matter more than company size for determining virtual CIO value. Businesses that rely heavily on technology for operations, customer service, or competitive advantage benefit significantly from strategic IT guidance regardless of employee count. A 12-person software development firm might need virtual CIO services more than a 50-person retail operation with simple technology requirements.

Growth stage companies find particular value in virtual CIO services. Businesses experiencing rapid expansion need IT strategies that scale with growth while avoiding costly infrastructure mistakes. Virtual CIOs help growing companies make technology investments that support long-term objectives rather than just immediate needs.

Connecticut businesses experiencing rapid technology expansion: moving to cloud services, implementing new software systems, or dealing with integration challenges: benefit significantly from vCIO guidance. The strategic oversight ensures new technologies actually work together and support business goals rather than creating fragmented systems.

Regulated industries like healthcare, finance, and legal services gain particular advantage from virtual CIOs who provide quarterly compliance assessments, policy development, and vendor vetting at a fraction of internal costs. These industries face complex technology requirements that benefit from specialized expertise without justifying full-time executive positions.

Multi-location operations often struggle with technology consistency and security across different sites. Virtual CIOs help standardize systems, implement centralized management, and ensure security policies are consistently applied regardless of location. This coordination is particularly valuable for Connecticut businesses with locations across multiple states.

Project-based technology needs align well with virtual CIO service models. Companies planning major technology implementations, security upgrades, or digital transformation initiatives benefit from intensive virtual CIO involvement during project phases, then reduced involvement during stable operational periods.

When Full-Time Leadership Still Makes Sense

The virtual model doesn't fit every scenario. Understanding when full-time IT leadership is necessary helps businesses make informed decisions rather than defaulting to cost savings.

Large internal IT departments require full-time management and leadership. Businesses with 5+ internal IT staff members need dedicated managers for effective team coordination, performance management, and strategic planning. Virtual CIOs can provide strategic oversight, but day-to-day IT management requires on-site leadership.

Mission-critical 24/7 operations often require immediate executive decision-making during emergencies. Manufacturing facilities, healthcare providers, and financial services companies with continuous operations may need on-site IT executives who can make rapid decisions during system failures or security incidents.

Highly regulated industries with complex compliance requirements might need dedicated IT executives who specialize in specific regulatory frameworks. While virtual CIOs can provide general compliance guidance, businesses subject to specialized regulations like SOX, HIPAA, or PCI-DSS might benefit from full-time expertise in these specific areas.

Significant on-premises infrastructure requires ongoing management attention that part-time services struggle to provide effectively. Companies with extensive server rooms, manufacturing equipment integration, or custom applications often need dedicated IT leadership for optimal system performance.

Competitive technology development requires full-time strategic attention. Companies where technology provides primary competitive advantage: software developers, technology manufacturers, or tech-enabled service providers: often need dedicated IT executives focused exclusively on technology strategy and innovation.

Geographic isolation can make virtual CIO services less effective when physical presence is frequently required. Rural Connecticut businesses with limited internet connectivity or operations requiring hands-on technical support might prefer local, full-time IT leadership.

Maximizing Value Through Hybrid Models

Many Connecticut businesses discover optimal results by combining virtual CIO strategic guidance with internal operational management. These hybrid approaches provide comprehensive IT leadership while maintaining cost effectiveness.

The vCIO + IT Manager model pairs virtual CIO strategic guidance with an IT Manager earning $70,000-$90,000 annually. The IT Manager handles daily operations, user support, and system maintenance while the vCIO provides strategic planning, vendor management, and quarterly business reviews. This combination typically costs $110,000-$135,000 annually: significantly less than a full-time CIO while providing both strategic and operational coverage.

Virtual CIO + Managed Service Provider combinations leverage the strengths of both service models. The MSP handles daily operations, monitoring, and technical support while the vCIO provides strategic oversight and ensures the MSP delivers value aligned with business goals. This separation ensures your IT strategy remains focused on business outcomes rather than getting distracted by operational details.

Project-specific engagement allows businesses to use virtual CIO services intensively during strategic planning or implementation phases, then reduce involvement during stable periods. This approach works well for businesses with cyclical technology needs or major upgrade projects that require temporary executive attention.

Industry-specific virtual CIOs provide specialized expertise for businesses with unique regulatory or operational requirements. Healthcare-focused virtual CIOs understand HIPAA compliance intricacies, while manufacturing specialists understand production system integration challenges. This specialization often provides better strategic value than generalist full-time executives.

Board-level technology representation through virtual CIO services helps businesses communicate technology strategies and risks to investors or board members. Virtual CIOs can provide quarterly technology reports, risk assessments, and strategic recommendations that demonstrate professional IT governance to external stakeholders.

Succession planning becomes simpler with virtual CIO services. Rather than worrying about key person risk when full-time IT executives leave, businesses with virtual CIO relationships maintain continuity through service provider transitions. This stability is particularly valuable for businesses dependent on consistent IT strategic guidance.

The Flexibility Factor

Virtual CIO services scale to match fluctuating business needs, ensuring optimal resource allocation without the fixed costs of full-time employees. This flexibility provides both financial and strategic advantages that traditional IT staffing cannot match.

Variable engagement levels adapt to business cycles, technology projects, and operational changes. During strategic planning periods or major technology implementations, virtual CIO involvement can increase to provide intensive guidance. During stable operational periods, service levels can decrease to minimize costs while maintaining strategic oversight.

Specialized expertise access provides capabilities that single individuals cannot offer. Virtual CIO services often include access to security specialists, cloud architects, and industry-specific experts who can provide targeted guidance for specific projects or challenges. This expert network would be impossible to maintain with internal staff.

Geographic flexibility enables virtual CIO services to support businesses with multiple locations or remote operations effectively. Virtual CIOs can provide consistent strategic guidance across different sites without travel costs or scheduling complexities that limit full-time executive effectiveness.

Technology neutrality ensures recommendations focus on business objectives rather than technology preferences or vendor relationships. Virtual CIOs evaluate solutions based on business requirements, cost-effectiveness, and long-term strategic value rather than personal familiarity or vendor partnerships.

Risk mitigation through service provider redundancy eliminates key person risk typical with full-time executives. If your virtual CIO becomes unavailable, service providers typically have backup personnel who understand your business and can maintain continuity. This redundancy is impossible with individual employees.

Cost predictability through fixed service agreements eliminates budget uncertainty typical with full-time employee costs. Virtual CIO services typically use fixed monthly or annual fees, making budget planning simpler and more accurate than managing employee costs with variable benefits, training, and retention expenses.

Strategic Technology Investments That Pay for Themselves

The strategic technology investments that virtual CIOs facilitate often yield returns that exceed their service costs, making the financial decision even more compelling for Connecticut small businesses.

Cloud migration strategies developed by virtual CIOs typically save businesses 30-50% on technology infrastructure costs while improving reliability and security. A Hartford professional services firm saved $78,000 annually by migrating to cloud services under virtual CIO guidance: more than covering their $35,000 annual vCIO investment.

Cybersecurity improvements prevent costly incidents that could devastate small businesses. Virtual CIOs help implement security measures that prevent breaches averaging $247,000 in total costs for Connecticut SMBs. Even preventing one major security incident justifies years of virtual CIO investment.

Vendor consolidation and contract optimization reduces technology costs through better purchasing decisions and contract negotiations. Virtual CIOs leverage industry knowledge and vendor relationships to secure better pricing and terms than individual businesses typically achieve independently.

Process automation implementations increase operational efficiency while reducing labor costs. Virtual CIOs identify automation opportunities that eliminate repetitive tasks, reduce errors, and free employees for higher-value activities. These productivity improvements often generate returns exceeding virtual CIO service costs.

Technology standardization reduces support costs, training requirements, and operational complexity. Virtual CIOs help businesses implement consistent technology platforms that simplify management, reduce security risks, and minimize ongoing support requirements.

Disaster recovery and business continuity planning prevents business-threatening operational disruptions. The strategic planning and implementation guidance provided by virtual CIOs ensures businesses can maintain operations during emergencies, preventing revenue losses that far exceed service costs.

Making the Strategic Decision

The evidence is clear: virtual CIO services provide superior value for most Connecticut small and medium businesses compared to full-time IT executives. The cost savings of 78-89% represent just the beginning of the value proposition. When you factor in strategic benefits, risk reduction, and flexibility advantages, virtual CIO services often provide better business outcomes at dramatically lower costs.

The key to success is selecting virtual CIO services aligned with your business needs, industry requirements, and growth objectives. Look for providers with relevant industry experience, proven methodologies, and the flexibility to adapt their services to your specific requirements.

Professional managed IT service providers often provide the best virtual CIO services because they combine strategic guidance with technical implementation capabilities. This integration ensures strategic recommendations can be effectively executed rather than remaining theoretical exercises.

The bottom line: virtual CIO services offer Connecticut small businesses access to executive-level IT strategy and guidance at a fraction of traditional costs. For most SMBs, this represents not just cost savings, but superior strategic outcomes that position them for long-term success in an increasingly technology-dependent business environment.

Connecticut's Privacy Law Hits July 2026: Are You Making These 7 Critical Compliance Mistakes That Could Fine Your Business $100K?

The Connecticut Data Protection Act (CTDPA) becomes enforceable on July 1, 2026, and most small businesses across the state are sleepwalking toward potential disaster. Unlike gradual regulatory rollouts, privacy laws hit with immediate financial consequences: fines of up to $5,000 per violation, with aggregate penalties reaching hundreds of thousands of dollars for systematic non-compliance.

A recent survey of Connecticut SMBs reveals alarming preparation gaps: 73% of businesses subject to the law haven't begun compliance efforts, 84% don't understand their obligations, and 91% have no idea what consumer data they actually collect and process. With less than 18 months until enforcement begins, businesses that don't act soon risk joining the growing list of companies facing regulatory penalties that threaten their survival.

The CTDPA affects any business that processes personal data of 100,000+ Connecticut residents annually OR derives 25% or more of revenue from selling personal data and processes data of 25,000+ residents. This threshold catches more businesses than most owners realize, particularly those with e-commerce operations, email marketing programs, or customer tracking systems.

The stakes couldn't be higher. California's similar privacy law generated over $1.2 billion in penalties during its first three years, with average fines for small businesses ranging from $75,000 to $150,000. Connecticut's enforcement timeline suggests similar financial consequences for unprepared businesses.

Mistake #1: Misunderstanding Who the Law Actually Covers

The most dangerous mistake Connecticut businesses make is assuming the CTDPA doesn't apply to them based on oversimplified threshold interpretations. The law's coverage criteria are more complex and far-reaching than most businesses realize, catching companies that consider themselves "too small" for privacy regulations.

The 100,000 consumer threshold includes any Connecticut resident whose personal data you process, not just direct customers. If your website uses analytics tools, advertising pixels, or social media integrations, you're likely processing data from thousands of Connecticut residents who never purchase from you. E-commerce sites with national reach often exceed the threshold within months of launch.

Revenue thresholds create hidden compliance obligations for businesses that sell customer lists, participate in affiliate marketing, or use customer data for advertising targeting. Companies deriving just 25% of revenue from data-related activities while processing data from 25,000+ Connecticut residents fall under CTDPA coverage regardless of total revenue size.

[IMAGE_HERE]

Third-party data processing expands coverage beyond direct customer relationships. If you use customer relationship management systems, email marketing platforms, or analytics tools that process Connecticut resident data, you become a "controller" under the law with full compliance obligations. Many businesses discover their SaaS subscriptions create unexpected regulatory exposure.

Website visitor tracking creates compliance obligations even for businesses without Connecticut customers. Tracking pixels, heat mapping tools, and user behavior analytics collect personal data from site visitors, including Connecticut residents. A manufacturing company with no Connecticut customers could still fall under CTDPA coverage due to website tracking of Connecticut visitors researching their industry.

Employee data processing adds another layer of coverage complexity. Connecticut businesses with remote employees or business relationships across state lines often process personal data of Connecticut residents through HR systems, payroll services, or business communications. This B2B data processing can trigger compliance obligations separate from customer-focused activities.

Marketing automation expands data processing beyond obvious customer interactions. Email marketing platforms, CRM systems, and advertising tools often process personal data from Connecticut residents who engage with your marketing but never become customers. Lead scoring, behavioral tracking, and prospect nurturing activities all constitute data processing under the CTDPA.

The practical implication: most Connecticut businesses with digital operations process personal data subject to CTDPA coverage. The question isn't whether the law applies: it's whether you understand your compliance obligations before enforcement begins.

Mistake #2: Failing to Map Your Data Collection and Processing

Connecticut businesses consistently underestimate the volume and variety of personal data they collect, process, and share. This blind spot creates massive compliance vulnerabilities because you can't protect data you don't know you have, and you can't respond to consumer requests for information you can't locate.

Website data collection extends far beyond obvious forms and purchases. Analytics tools collect IP addresses, device identifiers, browsing patterns, geographic locations, and behavioral profiles that constitute personal data under the CTDPA. Social media pixels, advertising trackers, and third-party widgets embedded in websites create additional data collection points that most businesses don't recognize.

Customer service interactions generate significant personal data beyond recorded conversations. Support ticket systems, chat logs, email exchanges, and phone call records often contain sensitive personal information, financial details, and behavioral patterns that require protection under privacy regulations. Many businesses store this information indefinitely without realizing their compliance obligations.

Financial transaction data includes far more than payment card information. Purchase histories, billing addresses, shipping preferences, payment methods, and transaction timing create detailed personal profiles subject to CTDPA protection. Subscription businesses and recurring billing systems generate particularly complex data processing obligations.

Third-party integrations multiply data processing complexity exponentially. Every SaaS tool, marketing platform, analytics service, and business application that accesses customer data creates processing relationships that must be documented and managed under privacy regulations. A typical small business often uses 15-25 such tools without understanding their data sharing implications.

Employee and contractor data processing creates internal compliance obligations. HR systems, payroll services, time tracking tools, and business communication platforms process personal data that requires protection under privacy laws. Remote work arrangements and contractor relationships expand this data processing beyond traditional employment boundaries.

Marketing automation creates extensive personal data processing through lead scoring, behavioral tracking, campaign targeting, and customer segmentation. Email marketing platforms, social media management tools, and advertising systems build detailed personal profiles that require careful management and protection.

The documentation requirements are extensive. Businesses must maintain records of what data they collect, why they collect it, how they process it, where they store it, who has access to it, how long they keep it, and with whom they share it. This documentation must be available for regulatory inspection and consumer requests.

Mistake #3: Ignoring Consumer Rights Implementation Requirements

The CTDPA grants Connecticut consumers specific rights regarding their personal data, and businesses must implement systems and processes to honor these rights. Failure to respond appropriately to consumer requests generates automatic violations that trigger regulatory penalties.

Right to know requests require businesses to provide detailed information about data processing activities within 45 days of receiving valid consumer requests. This includes disclosing what personal data you collect, how you use it, whether you sell it, with whom you share it, and how long you retain it. Many businesses lack systems to gather this information efficiently.

Right to access requests demand that businesses provide consumers with copies of all personal data processed about them. This goes beyond customer account information to include analytics data, behavioral profiles, inferences drawn from data processing, and any data obtained from third-party sources. Compiling this information often requires coordination across multiple systems and vendors.

Right to deletion requests require businesses to delete all personal data about consumers unless specific exceptions apply. This deletion must extend to backup systems, archived data, third-party processors, and any vendors who received the data. Many businesses discover their data architecture makes complete deletion technically challenging or impossible.

[IMAGE_HERE]

Right to correction allows consumers to request changes to inaccurate personal data. Businesses must verify accuracy and make corrections within 45 days, then notify any third parties who received the incorrect information. This process requires data validation procedures and vendor coordination that most small businesses haven't developed.

Right to opt-out prevents businesses from selling personal data, using it for targeted advertising, or making automated decisions that produce legal effects. Implementing opt-out mechanisms requires technical changes to websites, data processing systems, and third-party integrations that can be complex and expensive.

Data portability rights require businesses to provide personal data in structured, commonly used formats that consumers can transfer to other businesses. This technical requirement often necessitates system modifications or custom development work that many businesses haven't budgeted for.

Appeal processes must allow consumers to challenge business responses to rights requests. When businesses deny consumer requests, they must provide appeals mechanisms and respond to appeals within 60 days. This requires additional staff training and process development beyond initial request handling.

Verification procedures must confirm consumer identities before responding to rights requests while balancing security with accessibility. Businesses must implement reasonable verification methods that protect against fraudulent requests without creating excessive barriers for legitimate consumers.

Mistake #4: Inadequate Vendor and Third-Party Management

Connecticut businesses often overlook their responsibility for personal data processed by vendors, contractors, and third-party services. Under the CTDPA, businesses remain fully liable for privacy violations committed by their service providers, making vendor management a critical compliance component.

Data processing agreements must be established with every vendor that processes personal data on your behalf. These contracts must specify data processing purposes, define security requirements, limit data use to specified purposes, require deletion upon contract termination, and include audit rights. Most businesses use vendor contracts that lack adequate privacy protections.

Vendor security assessments become mandatory for any provider processing personal data. Businesses must evaluate vendor security practices, data protection policies, incident response procedures, and compliance capabilities before engaging services. This due diligence requirement extends beyond initial vendor selection to ongoing monitoring throughout the relationship.

International data transfers require additional safeguards when vendors process personal data outside the United States. While the CTDPA doesn't prohibit international transfers, businesses must ensure adequate data protection through contractual safeguards, certification programs, or approved transfer mechanisms.

Subcontractor management extends compliance obligations through the entire vendor chain. When your vendors use subcontractors to process personal data, you must ensure those subcontractors meet the same privacy and security standards. This multi-layer vendor management creates complex oversight requirements.

Data breach notification requirements apply to vendor-caused incidents. When vendors experience data breaches involving your customers' personal data, you must notify affected consumers and regulatory authorities within specified timeframes. This requires vendor contracts that ensure prompt breach notification and detailed incident information.

Termination procedures must ensure complete data deletion when vendor relationships end. Contracts must specify data return or destruction requirements, provide verification of deletion, and address ongoing obligations for any data that cannot be deleted due to legal requirements.

The practical challenge: most Connecticut small businesses use dozens of vendors that process personal data: cloud storage providers, email services, payment processors, marketing tools, analytics platforms, and business applications. Each vendor relationship requires privacy-compliant contracts and ongoing oversight.

Mistake #5: Insufficient Data Security and Breach Response Planning

Data security requirements under the CTDPA go beyond basic cybersecurity to include specific technical and organizational measures designed to protect personal data. Businesses must implement "reasonable" security measures appropriate to the volume and nature of personal data they process.

Technical safeguards must include encryption for data in transit and at rest, access controls that limit data access to authorized personnel, regular security updates and patch management, secure data backup and recovery procedures, and network security measures that prevent unauthorized access. These requirements often necessitate security upgrades that many small businesses haven't implemented.

Organizational measures include employee training on data protection procedures, documented security policies and procedures, regular security risk assessments, incident response plans, and vendor security management. These administrative safeguards often require significant process development and staff training investments.

Data breach response plans must address detection, assessment, containment, investigation, and notification requirements specific to personal data incidents. Businesses must notify consumers within 60 days of discovering breaches that pose risks of harm, provide specific information about the incident, and offer appropriate remediation measures.

[IMAGE_HERE]

Breach notification procedures require coordination with law enforcement, regulatory authorities, and affected consumers within tight timeframes. Businesses must maintain contact information for relevant authorities, develop notification templates that include required information, and establish decision-making processes for determining notification requirements.

Risk assessment procedures must identify potential threats to personal data, evaluate the likelihood and impact of various security incidents, and implement appropriate safeguards based on risk levels. This ongoing assessment process requires regular updates as business operations and threat landscapes evolve.

Documentation requirements extend to security policies, incident response procedures, employee training records, and risk assessment results. Regulatory authorities expect businesses to demonstrate reasonable security measures through documented policies and implementation evidence.

The financial implications are significant. Data breach costs for Connecticut small businesses average $147,000 per incident, including notification costs, regulatory fines, legal fees, and business disruption. Investing in preventive security measures typically costs far less than responding to actual breaches.

Mistake #6: Mishandling Sensitive Personal Data

The CTDPA provides enhanced protections for sensitive personal data, including biometric identifiers, health information, financial data, precise geolocation, and information about children. Businesses processing sensitive data face heightened compliance obligations and increased penalty risks.

Biometric data processing requires explicit consent and additional security measures. This includes fingerprint scanners for employee access, facial recognition systems, voice prints for authentication, and any biological identifiers used for identification purposes. Many businesses don't realize their employee security systems create sensitive data processing obligations.

Health information processing extends beyond traditional healthcare to include fitness tracking, wellness programs, and any health-related data collected by employers or service providers. The intersection of CTDPA requirements with HIPAA obligations creates complex compliance scenarios for businesses in health-adjacent industries.

Financial data protection requirements apply to any business handling payment information, credit reports, banking details, or financial account information. While payment card industry standards address security requirements, the CTDPA adds consumer rights and consent requirements that extend beyond traditional PCI compliance.

Geolocation data from mobile applications, websites, and business systems requires careful handling when it provides precise location information. General geographic data may not qualify as sensitive, but GPS coordinates, specific addresses, and movement tracking create enhanced protection obligations.

Children's data processing triggers strict consent and security requirements for any business that knowingly processes personal data from consumers under age 16. This includes educational technology, gaming applications, social media platforms, and any service that appeals to or markets to children.

Explicit consent requirements for sensitive data processing differ from general consent standards. Businesses must obtain clear, specific agreement for sensitive data processing, explain the purposes and risks involved, and provide easy withdrawal mechanisms. General terms of service acceptance typically doesn't satisfy these heightened consent requirements.

Data minimization principles require businesses to collect only sensitive personal data that's necessary for specified purposes, retain it only as long as needed, and limit access to authorized personnel with legitimate business needs. These principles often require significant changes to data collection and retention practices.

Mistake #7: Procrastinating on Implementation Planning

With enforcement beginning July 1, 2026, Connecticut businesses have limited time to achieve compliance: and implementation takes far longer than most companies anticipate. The businesses that start planning now will have competitive advantages over those scrambling to comply at the last minute.

Timeline realities show that comprehensive privacy compliance typically requires 12-18 months for small businesses, including vendor negotiations, system modifications, process development, staff training, and compliance testing. Businesses starting implementation in 2025 face rushed timelines that increase costs and compliance risks.

Budgeting requirements often surprise small business owners. Comprehensive privacy compliance typically costs $25,000-$75,000 for small businesses, including legal fees, system modifications, staff training, vendor contract updates, and ongoing compliance management. These costs increase significantly when implementation is rushed.

Resource allocation requires dedicated staff time for compliance project management, vendor coordination, employee training, and ongoing privacy operations. Many businesses underestimate the human resources required for privacy compliance, leading to implementation delays and cost overruns.

Legal assistance becomes essential for contract reviews, policy development, compliance assessments, and regulatory interpretation. Privacy law complexity requires specialized legal expertise that most business attorneys don't possess, necessitating engagement with privacy law specialists.

System modifications often require technical expertise beyond internal capabilities. Implementing consumer rights request systems, updating data collection practices, modifying third-party integrations, and enhancing security measures frequently require external technical assistance.

Change management challenges emerge when privacy compliance requires modifications to established business practices. Employee resistance, customer communication challenges, and operational disruptions can delay implementation and create ongoing compliance risks.

Competitive implications favor early adopters who can use privacy compliance as a competitive advantage. Businesses that achieve compliance early can market their privacy commitments, build customer trust, and avoid the operational disruptions that late adopters experience during rushed implementation.

Building Effective Compliance Strategies

Successful CTDPA compliance requires systematic approaches that address all law requirements while fitting within business operational and financial constraints. The most effective strategies break compliance into manageable phases that build upon each other.

Data inventory and mapping provide the foundation for all other compliance activities. Businesses must document what personal data they collect, where it's stored, how it's processed, and with whom it's shared. This inventory process often reveals surprising data collection practices and integration complexities that inform compliance planning.

Risk assessment helps prioritize compliance efforts based on violation likelihood and potential consequences. Businesses processing large volumes of sensitive data face higher risks than those with minimal personal data processing. This risk-based approach helps allocate limited compliance resources effectively.

Policy development creates the operational framework for privacy compliance. Businesses need privacy policies, data processing procedures, consumer rights response protocols, vendor management requirements, and incident response plans. These policies must be practical and implementable, not just legally compliant documents.

Staff training ensures effective policy implementation and creates a culture of privacy awareness. Employees must understand their privacy responsibilities, recognize personal data handling requirements, and know how to respond to consumer requests. Ongoing training programs keep privacy awareness current as business operations evolve.

Technology implementation provides the tools necessary for compliance management. This includes consumer request management systems, data inventory tools, security enhancements, and vendor management platforms. Technology solutions can automate routine compliance tasks while ensuring consistent policy implementation.

Vendor management requires updating contracts, assessing security practices, and establishing ongoing oversight procedures. This process often takes months due to vendor negotiation timelines and the complexity of privacy-compliant contract terms.

Professional assistance from managed IT service providers with privacy expertise can accelerate compliance implementation while ensuring technical requirements are properly addressed. These partnerships provide access to specialized knowledge and implementation resources that most small businesses cannot maintain internally.

The message for Connecticut businesses is clear: privacy compliance is not optional, and the window for effective preparation is rapidly closing. Businesses that act now can achieve compliance efficiently and cost-effectively. Those that wait face rushed implementation timelines, higher costs, and increased risks of regulatory penalties that could threaten their survival.

The CTDPA represents a fundamental shift in how businesses must handle personal data. Success requires treating privacy compliance as an ongoing operational requirement rather than a one-time legal exercise. With proper planning and implementation, Connecticut businesses can turn privacy compliance into a competitive advantage that builds customer trust and supports long-term growth.

Why 95% of Phishing Attacks Work on Connecticut SMBs (And the 3-Minute Defense Strategy That Stops Them Cold)

At 2:17 PM on a Tuesday, Jessica, the office manager at a thriving Hartford law firm, received an urgent email from what appeared to be the firm's bank. The message warned that suspicious activity had been detected on the business account and immediate verification was required to prevent account suspension. The email included official-looking logos, matched the bank's typical formatting, and provided a link to resolve the issue quickly.

Within minutes, Jessica had entered the firm's banking credentials, unknowingly handing over access to $340,000 in client funds. By the time the genuine fraud alert arrived three hours later, the damage was done. The attack wasn't sophisticated: it was a standard phishing email that succeeds against 95% of Connecticut small businesses because it exploited basic human psychology, not advanced technical vulnerabilities.

This scenario plays out hundreds of times each month across Connecticut. Despite billions invested in cybersecurity technology, phishing attacks continue to succeed because they target the weakest link in every security system: human decision-making under pressure. The most expensive firewalls and antivirus software become worthless when employees voluntarily provide access to systems and data.

The shocking reality is that phishing attacks work not because they're technically sophisticated, but because they're psychologically effective. They exploit universal human tendencies: urgency bias, authority deference, and the desire to be helpful. Understanding these psychological mechanisms: and implementing simple countermeasures: can stop 99% of phishing attacks within minutes of implementation.

The Anatomy of Modern Phishing Success

Modern phishing attacks succeed through psychological manipulation rather than technical sophistication. Attackers have shifted from obvious scams targeting personal greed to subtle impersonations exploiting professional responsibilities and workplace pressures.

Authority impersonation tops the list of effective phishing techniques. Emails appearing to come from executives, IT departments, banks, or government agencies trigger automatic compliance responses in most recipients. The Hartford law firm attack succeeded because employees are conditioned to respond quickly to apparent banking security issues, especially when framed as protecting client assets.

[IMAGE_HERE]

Urgency creation bypasses normal verification procedures by creating artificial time pressure. Phrases like "immediate action required," "account will be suspended," or "respond within 24 hours" trigger fight-or-flight responses that override careful thinking. Under perceived time pressure, people make rapid decisions using emotional rather than logical reasoning processes.